Toward the end of 2020, the only thing more pervasive than COVID-19 was “WAP” by Cardi B and Megan Thee Stallion. A song whose prowess carried over into early 2021, just as coronavirus did. At that time, TikTok was also blowing up more than ever. In large part thanks to “at-home culture” “thriving.” When corona first hit at the beginning of 2020, Megan Thee Stallion was having a moment all her own thanks to the “Savage” challenge that went viral on the app. A detail that also comes into play during Dumb Money, when a GameStop employee named Marcos Barcia (Anthony Ramos) trolls his boss, Brad (Dane DeHaan), after the latter tells him that while he can’t give him an advance on his paycheck, he can compete to win “ten labor hours” (presumably, that means ten hours’ worth of wages) by participating in a TikTok lip sync contest.

This, of course, happens after “WAP” soundtracks the intro to Dumb Money, as Gabe Plotkin (Seth Rogen) frantically runs through his multimillion dollar property upon being told to “dial in” by fellow hedge fund CEO Steve Cohen (played by an ever-mutating Vincent D’Onofrio). It is Cohen who informs Plotkin that, “They’re holding” (in other words, they’ve got “diamond hands”). The “they” in this scenario being the proverbial “little guy.” The David to Wall Street’s Goliath. And the representative for all the Davids of the U.S. at large is Keith Gill (Paul Dano) a.k.a. Roaring Kitty a.k.a. Deep Fucking Value. Although a financial analyst at MassMutual by day, Keith’s real passion appears to be his post-work life as a “recreational YouTuber.” And it’s one he ostensibly disappears deeper into after the death of his sister, Sara (the cause of which we’re made to assume was from Covid).

This is what the viewer sees when the film cuts to six months earlier, smack-dab in the middle of 2020. Meeting with his friend and financial colleague, Briggsy (Deniz Akdeniz), Keith tells him about his decision to double down on investing in GameStop stock. Which Briggsy bills as “penny stocks” (but hey, those were good enough to make Jordan Belfort a rich man, n’est-ce pas?). Keith insists 1) GameStop is not that and 2) it’s highly undervalued. The obvious metaphor tying into how the “average joe” is consistently undervalued, too. And what business could be more tailored toward such a demographic than GameStop (apart from, say, Home Depot)? He then lays into Briggsy about how “Wall Street gets it wrong all the time. Look at ‘08. These guys, they have all the money, and the fancy degrees, and the political juice in the world and they get it wrong all the time.” Briggsy still warns, “You never bet against Wall Street.” Wall Street, too, is well-aware of its rigged system. The one that everybody on the inside benefits from, including men like Plotkin, Cohen and Ken Griffin (played to perfection by Nick Offerman), the eerily stoic (like, Dick Cheney-level) CEO of Citadel.

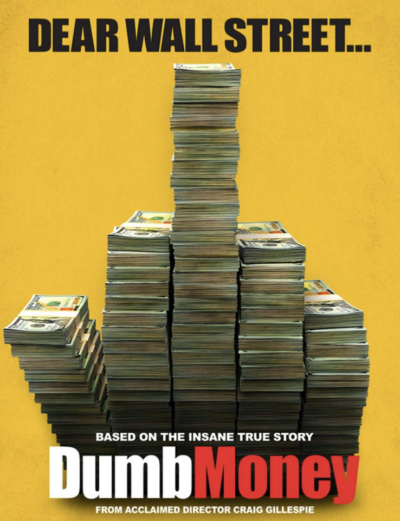

These are the men who refer to people like Keith as “dumb money” (the asterisk given with said title card of the movie being: “*individual investors often derided as ‘dumb money’ by Wall Street”). But Keith, at six months into 2020, is about to show these fucks just who, exactly, is the dumb one. Rallying his ever-burgeoning Reddit following, co-screenwriters Lauren Schuker Blum and Rebecca Angelo easily render Gill into a modern-day Robin Hood (and, to be sure, the app of the same name plays heavily into the narrative), taking money from the rich prematurely offloading their GameStop stocks (i.e., “shorting”) and putting it into the “pockets” of the everyman. Including essential health care workers like Jenny (America Ferrera, who is having her best year ever in the mainstream thanks to Barbie and this film, to boot). Among others like Marcos and college students Riri (Myha’la Herrold) and Harmony (Talia Ryder), these are the “subreddits” of the movie that thread together a larger point/theme. A point/theme that should be fairly overt to everyone by now, especially the rich (*cough cough* Wall Street finance bros). Then again, denial isn’t just a river in a hedge fund manager’s backyard.

And yet, although ignoring the contempt of the poor (read: everyone except the rich at this juncture) was relatively easy to do before 2020, this was a year when the internet became an echo chamber of unprecedented rage (markedly propelled by the filmed murder of George Floyd in late May—itself given a nod to in Dumb Money when Marcos passes a wall of graffiti that reads, “Fuck the Cops,” “Black Lives Matter” and “I Can’t Breathe”). A platform for expressing the extreme dissatisfaction that has been percolating for decades vis-à-vis capitalism and the lie it continues to sell about “everyone” having an “equal” chance to “get ahead” (this, of course, alluding to amassing as much money as possible, because that’s all we’ve been conditioned to believe really matters—and yes, people like Cardi B and Megan Thee Stallion only perpetuate that message with their money-worshiping lyrics).

Never had it been made more patently clear that that simply wasn’t the case when coronavirus came to roost, and the accompanying lockdowns that classified the lowest-paid workers as essential compared to the richest “workers” who were told to “stay home, stay safe” made it laughably apparent just how unfair this whole game has been. While the fat cats were allowed to safely shelter in place in their posh homes, those paid in peanuts and balcony applause to risk their lives were made to suffer more than ever. And all without any promise of higher pay. So what is being “essential” really worth to he who controls the market? Because, in the end, no matter what, the Goliaths will be able to get what they want out of the Davids of the world, somehow managing to push them into submission one way or the other. In Gill and his acolytes’ case, that came in the form of shutting off access to the r/WallStreetBets forum under the guise of espousing “hateful and discriminatory content” that “violated Reddit’s code of conduct.” Ha! So it’s okay for the rich to make an entire affluent existence out of discriminating and being hateful toward the have-nots, but when the latter group tries to take a stand only then can it be called what it is? Oh hell no.

And when Keith commences his “thesis” on GameStop, he’s right to say, “The value is overlooked. Wall Street just doesn’t see it. Why?… The hedge funds are overlooking the value of the company just like they overlook the people who shop there.” The same kind of people who will continue to be overlooked now that the GameStop “fiasco” is “over.” And, in effect, it is. For the consequences, as usual, did not fit the crime (the SEC made no charges, not even against Ken Griffin). And people like Marcos, although slightly vindicated, continued to get the fuzzy end of the lollipop. Just as he does in having to ride the bus to work during the pandemic (GameStop found a loophole for staying open by declaring itself a purveyor of “essential products” to keep people connected while “working from home” [read: playing video games]). And when he finally gets off the bus to enter a deserted Detroit mall that houses, among other shops, a GameStop, the viewer can then see the ad on the side of the bus that reads: “Money burning a hole in your pocket? We’ll get you some more.” It’s only too appropriate when applied to the stock market as an American casino. Not to mention the way Americans in general are “incentivized” to operate on credit, to incur a negative balance that will keep them constantly on some lender’s hook. This ceaseless, propagandizing encouragement in the U.S. to borrow money and effectively gamble on yourself (knowing full well the system doesn’t want you to be a winner) is what’s at play in Dumb Money as well. Except the hedge fund fucks “in charge” were never banking on the everyman’s “deluded” self-confidence to actually pay off.

Never seeing the short squeeze on the horizon at all, despite how clear it was becoming throughout 2020. And yes, those reminded of The Big Short by the term “short squeeze” wouldn’t be wrong to make the correlation. After all, said 2015 movie also relates to rigged market fuckery and is based on a book: Michael Lewis’ The Big Short: Inside the Doomsday Machine. Just as Dumb Money is based on Ben Mezrich’s 2021 tome (that’s right, the book came out the same year as the “incident” itself), The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees. While The Big Short was released almost a full decade after the debacle it addresses, Dumb Money is yet another prime example not just of the possibilities when “the plebes” are united in a cause, but also of the collective’s more recent obsession with looking back on the immediate past as though enough time has gone by to truly grasp the impact of what happened.

In the directorial care of Craig Gillespie (of Cruella and I, Tonya repute), that “grasp” becomes automatically comedic…even if it isn’t able to fully comprehend, so soon after it happened, the full weight of what occurred. The same goes for coronavirus itself, which most people have opted to sweep under the rug in terms of not wanting to remember “that time.” Preferring, instead, to pretend it never existed. In many respects, the attitude taken is tantamount to the cliche of everyone masturbating on a plane as they think it’s about to crash, only to realize the aircraft has righted itself and life will continue on for the time being. Afterward, everyone pretends that no one whipped it out in what they thought would be their final moments. That’s what coronavirus and its lockdown behavior mirrored.

As 2020 came to a close and corona continued to rage on, the sequestering required of people created an unprecedented online environment. A cauldron, if you will, for something like the subreddit of Wall Street Bets to brew into an entire movement. One that was, needless to say, a movement geared toward taking down the rich. Who had only gotten richer during the pandemic while the rest of the working-class “schmucks” lost their already paltry livelihood.

Perhaps what’s most striking of all about Dumb Money (even more than the hubris of the rich) is how it forces viewers to remember that “period” not so long ago. Capturing a moment when complacency had subsided, in large part, thanks to having so much “free time” to actually rail against the oppressor. And the last thing an oppressor wants is for his serfs to have too much free time to think about what a fucked system this is (glorified feudalism, in case you couldn’t guess). Hence, the urgency with which the masses were ferried back to “normal.” With nobody seeming all that concerned about acknowledging the shellshock of what transpired. Just as no one is with acknowledging the (enduring) lack of fairness in the stock market (“fair market” being an especial oxymoron here). No matter what kind of “movement” Keith may have started.

Per the film’s title card epilogue, that movement is summed up as follows: “Because of the GameStop rally, 85% of hedge funds now scour the internet to see where retail traders are investing. Fearing another short squeeze, funds have dramatically reduced their short positions. Wall Street will never be able to ignore the so-called ‘dumb money’ again.” Though that remains debatable.

And then there is the matter of refusing to acknowledge that what actually needs to change isn’t “leveling the playing field” so that broke asses can become just as cunty as richies, but blowing up the entire system, including its major capitalist trappings. I.e., the stock market.